Arizona taxpayers have a rare opportunity to directly support older adults in their community and receive every dollar of their donation back as a dollar for dollar credit on their Arizona state taxes.

The Arizona Charitable Tax Credit allows you to choose where a portion of your state tax dollars goes. Instead of sending that money to the state, you can redirect it to a local nonprofit like Aster Aging serving vulnerable seniors and receive the same amount back when you file your taxes.

What Is the Arizona Charitable Tax Credit?

The Arizona Charitable Tax Credit allows eligible taxpayers to claim a tax credit for donations made to approved Qualifying Charitable Organizations that provide direct services to people in need.

This is not a tax deduction. A deduction reduces taxable income. A tax credit reduces the amount of tax you owe to the state dollar for dollar. If you owe Arizona taxes, your donation can reduce that bill by the exact amount you give, up to the allowable limit.

Aster Aging is a Qualifying Charitable Organization under this program. Our QCO code is 20426.

How the “No Net Cost” Works

If you owe Arizona state income tax, a charitable tax credit donation can effectively cost you nothing.

For example, if you owe $500 in Arizona taxes and donate $500 to Aster Aging, you may be able to reduce your state tax bill by $500. Instead of paying that money to the state, you direct it to services that help older adults in your community.

Many donors either reduce what they owe or increase their Arizona tax refund by the amount of their donation. Individual tax situations vary, so donors should consult a qualified tax professional to understand how the credit applies to them.

How Much Can You Claim?

The allowable credit amounts are set by the Arizona Department of Revenue and may change year over year.

2025 tax year

- Individuals: up to $495

- Couples filing jointly: up to $987

2026 tax year

- Individuals: up to $506

- Couples filing jointly: up to $1,009

Donations made by the tax filing deadline may be eligible for the credit.

Where Your Donation Goes

Aster Aging provides direct, daily support to thousands of older adults in our community who are struggling with basic needs.

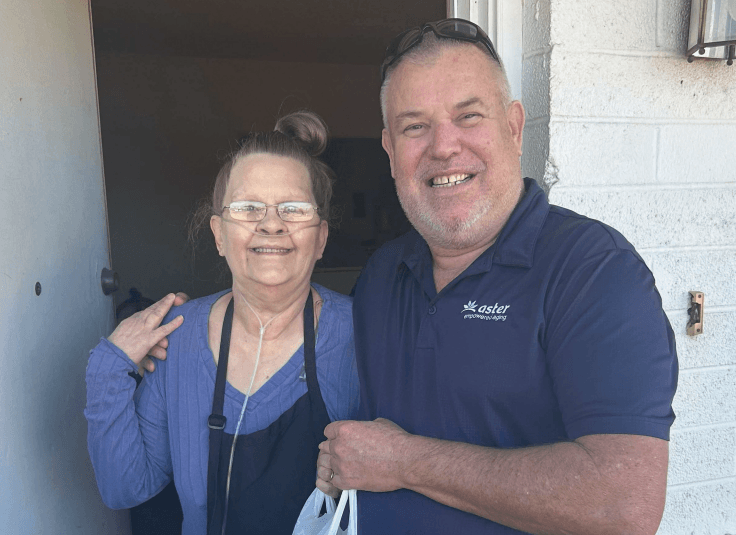

Founded in 1979, Aster Aging is a 501(c)(3) nonprofit serving older adults throughout Arizona’s East Valley. Each year, we support thousands of seniors through hands on services that address real, immediate needs, including:

In Home Support

Help with daily living so older adults can remain safely in their own homes.

Meals on Wheels

Nutritious meals delivered to seniors who are homebound, isolated, or unable to prepare food for themselves.

Outreach and Social Services

Personalized guidance, referrals, and advocacy for older adults and families navigating complex challenges.

Senior Centers

Community spaces that combat isolation and provide social connection, wellness activities, and access to essential resources.

For many of the people we serve, these services are the difference between stability and crisis, between independence and displacement.

Why Choose Aster Aging?

When you donate through the Arizona Charitable Tax Credit, you are not making a symbolic gesture. You are funding concrete services delivered locally.

Your donation stays in the East Valley and directly supports older adults who depend on these programs to survive and remain connected.

Make Your Tax Credit Donation Count

Charitable tax credit donations must be made by the applicable tax deadline to qualify. Waiting until the last-minute risks missing the opportunity to redirect your tax dollars where they can do real good.

To make a donation or ask questions about the Arizona Charitable Tax Credit, contact Aster Aging’s Development team at 480-219-3208 or development@asteraz.org.

You can also find additional information on the Arizona Department of Revenue website.

By taking advantage of the Arizona Charitable Tax Credit, you can fulfill your tax obligation while ensuring vulnerable seniors receive the care, nutrition, and support they need.

Make A Tax Credit Donation Today

Please note that individual circumstances may vary - talk to your tax professional to understand the full implications of your tax credit donation.